Discover the hidden ways employees may be stealing from your bar and how to prevent it.

Understanding the impact of employee theft in bars

Employee theft in bars can have a significant impact on the business, both financially and reputationally. The stolen items or money can result in immediate losses for the bar, affecting its profitability. Additionally, employee theft can damage the trust and loyalty of customers, leading to a decline in patronage. It is crucial for bar owners to understand the negative consequences of employee theft in order to take appropriate measures to prevent it.

Another paragraph about understanding the impact of employee theft in bars.

Common methods of employee theft in bars

There are various common methods that employees may use to steal from bars. One method is skimming, where employees take cash directly from the register before it is recorded. Another method is over-pouring, where bartenders pour excessive amounts of alcohol into drinks and pocket the difference. Employees may also engage in undercharging, where they deliberately charge customers less than the actual price of the items. Additionally, theft of inventory such as liquor bottles or food supplies is another common method of employee theft in bars.

Another paragraph about common methods of employee theft in bars.

Signs to look out for in detecting employee theft

There are several signs that bar owners can look out for to detect employee theft. One sign is a discrepancy between the amount of cash recorded in the register and the actual cash on hand. If the numbers don't match up, it could be an indication of theft. Another sign is a sudden increase in inventory shrinkage or missing items. Unexplained changes in employee behavior, such as a reluctance to take time off or a sudden change in personal appearance, can also be red flags. It is important to be vigilant and observant to identify potential signs of employee theft.

Another paragraph about signs to look out for in detecting employee theft.

Preventative measures to combat employee theft

To combat employee theft in bars, there are several preventative measures that can be implemented. First and foremost, it is important to have a strong hiring process in place, including thorough background checks and reference checks. Implementing a system of checks and balances, such as having multiple employees involved in cash handling and inventory management, can help deter theft. Regular inventory audits and surprise cash register counts can also help identify any discrepancies. Proper training and clear communication of expectations can also play a crucial role in preventing employee theft.

Another paragraph about preventative measures to combat employee theft.

Legal implications and consequences of employee theft in bars

Employee theft in bars can have serious legal implications and consequences. Depending on the severity of the theft, employees can face criminal charges and potential jail time. Bar owners may also pursue civil litigation to recover damages caused by the theft. In addition to legal consequences, employee theft can result in termination of employment and damage to the employee's professional reputation. It is important for both bar owners and employees to be aware of the potential legal ramifications of employee theft.

Another paragraph about legal implications and consequences of employee theft in bars.

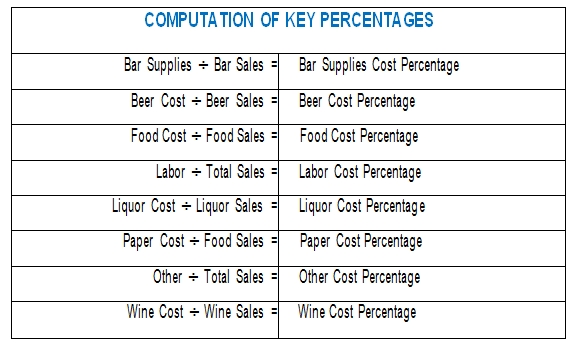

At the end of each month, it is important to close out all expenses and sales and balance all accounts. This process ensures that finances are being monitored and helps prevent financial problems down the line. It also lets you, the bar manager, see whether the bar is making a profit or not and what changes (if any) need to be made to operations.

At the end of each month, it is important to close out all expenses and sales and balance all accounts. This process ensures that finances are being monitored and helps prevent financial problems down the line. It also lets you, the bar manager, see whether the bar is making a profit or not and what changes (if any) need to be made to operations.

Industry studies have consistently shown that a full 25% to 30% of a bar's liquor inventory never converts into registered sales. That is the equivalent of about six to eight 1.25 oz portions per bottle (which should yield at least 25 portions.) This loss of liquor volume--due to unauthorized comps, over-pouring, spillage or theft--should be of great concern to any bar manager.

Industry studies have consistently shown that a full 25% to 30% of a bar's liquor inventory never converts into registered sales. That is the equivalent of about six to eight 1.25 oz portions per bottle (which should yield at least 25 portions.) This loss of liquor volume--due to unauthorized comps, over-pouring, spillage or theft--should be of great concern to any bar manager.  By Chris Parry

By Chris Parry